Renters Insurance in and around Sun City

Get renters insurance in Sun City

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Your rented space is home. Since that is where you relax and make memories, it can be a wise idea to make sure you have renters insurance, whether or not your landlord requires it. Even for stuff like your video games, smartphone, desk, etc., choosing the right coverage can help protect you from the unexpected.

Get renters insurance in Sun City

Rent wisely with insurance from State Farm

There's No Place Like Home

Renters frequently underestimate the cost of replacing their belongings. Just because you are renting a condo or space, you still own plenty of property and personal items—such as a a video game system, set of golf clubs, desk, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why secure your belongings with renters insurance from Bill Romley? You need an agent who is dedicated to helping you understand your coverage options and evaluate your risks. With personal attention and efficiency, Bill Romley is waiting to help you insure your precious valuables.

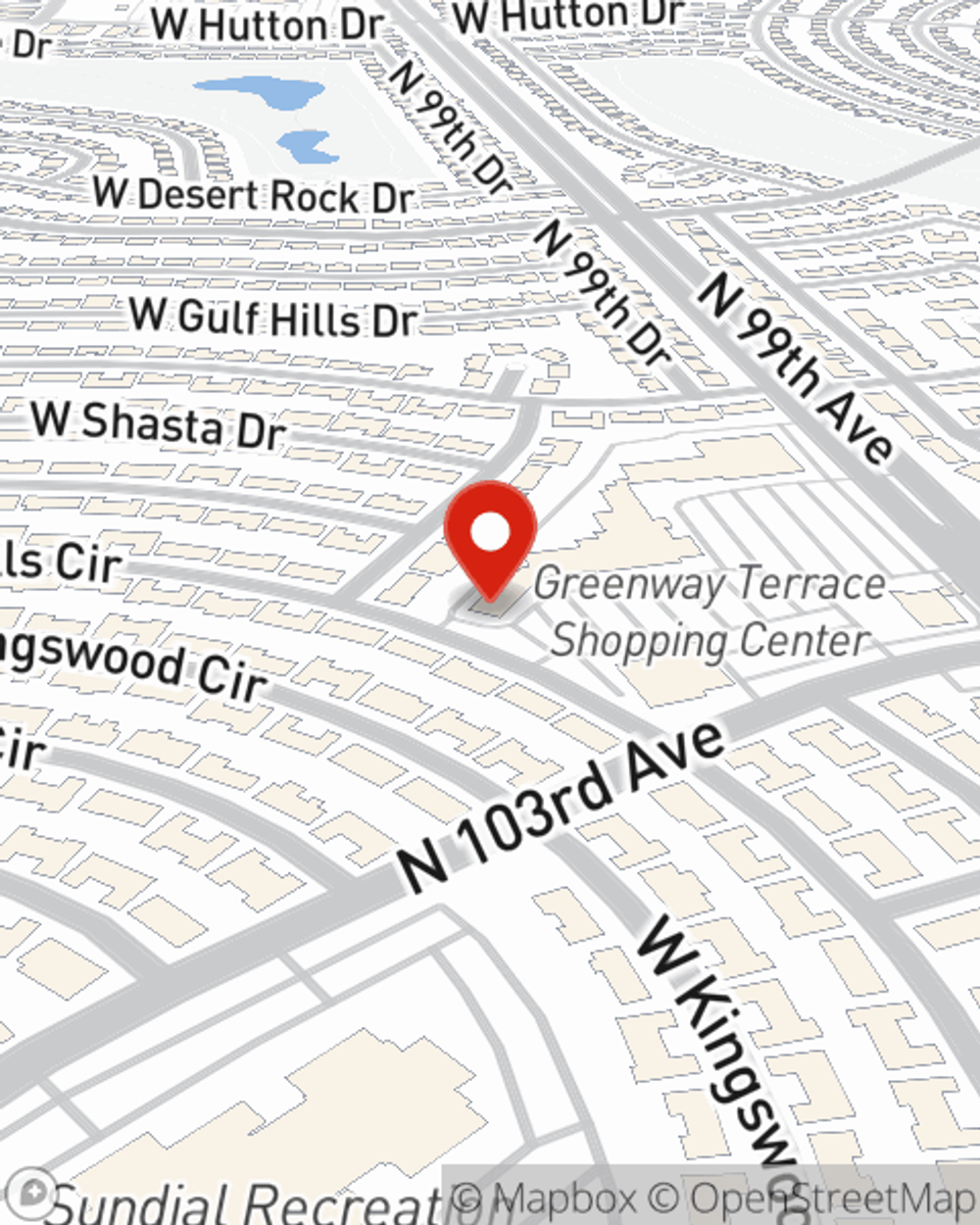

Renters of Sun City, get in touch with Bill Romley's office to learn more about your specific options and how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Bill at (623) 875-8300 or visit our FAQ page.

Simple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Bill Romley

State Farm® Insurance AgentSimple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.